Procuritas – SFDR Disclosures – Principal Adverse Impacts

Statement on principal adverse impacts of investment decisions on sustainability factors

Financial market participant Procuritas Capital Investors VII

Summary

Procuritas Capital Investors VII (Procuritas Capital Investors VII (E) AB, Swedish Reg. No. 559325-9111, Procuritas Capital Investors VII (D) AB Swedish Reg. No. 559325-9103 and Procuritas Capital Investors VII Co-Investment AB, Swedish Reg. No. 559366-4138) considers principal adverse impacts of its investment decisions on sustainability factors. The present statement is the consolidated statement on principal adverse impacts on sustainability factors of Procuritas Capital Investors VII.

This statement on principal adverse impacts on sustainability factors covers the reference period from 1 January to 31 December year 2024

Procuritas Capital Investor VII (from now on named ‘Procuritas’) invests in a wide range of sectors which makes the relevant principle adverse impact of its investments vary from company to company. When making investment decisions for the Fund, Procuritas explicitly screens for sustainability-related risks and opportunities, as well as negative and positive impacts that the investment has or might have. Every investment opportunity Procuritas reviews will be subject both to a high-level sustainability analysis and to a more thorough sustainability due diligence to determine the most material sustainability risks and aspects related to the investee company. Procuritas has an exclusion list that prohibits it from investing in companies related to arms, gambling, the sex industry or producing or wholesaling of alcohol, tobacco or drugs.

Procuritas believes that investment decisions that negatively impact climate or other environment-related resources, or have negative implications for people or society, are detrimental to value creation. To this end, Procuritas considers the principal adverse impacts of its investment decisions on sustainability factors throughout all major steps of the investment and portfolio management process. The principal adverse impact indicators are currently being reported directly from the portfolio companies and monitored by Procuritas once a year as part of the data-gathering process.

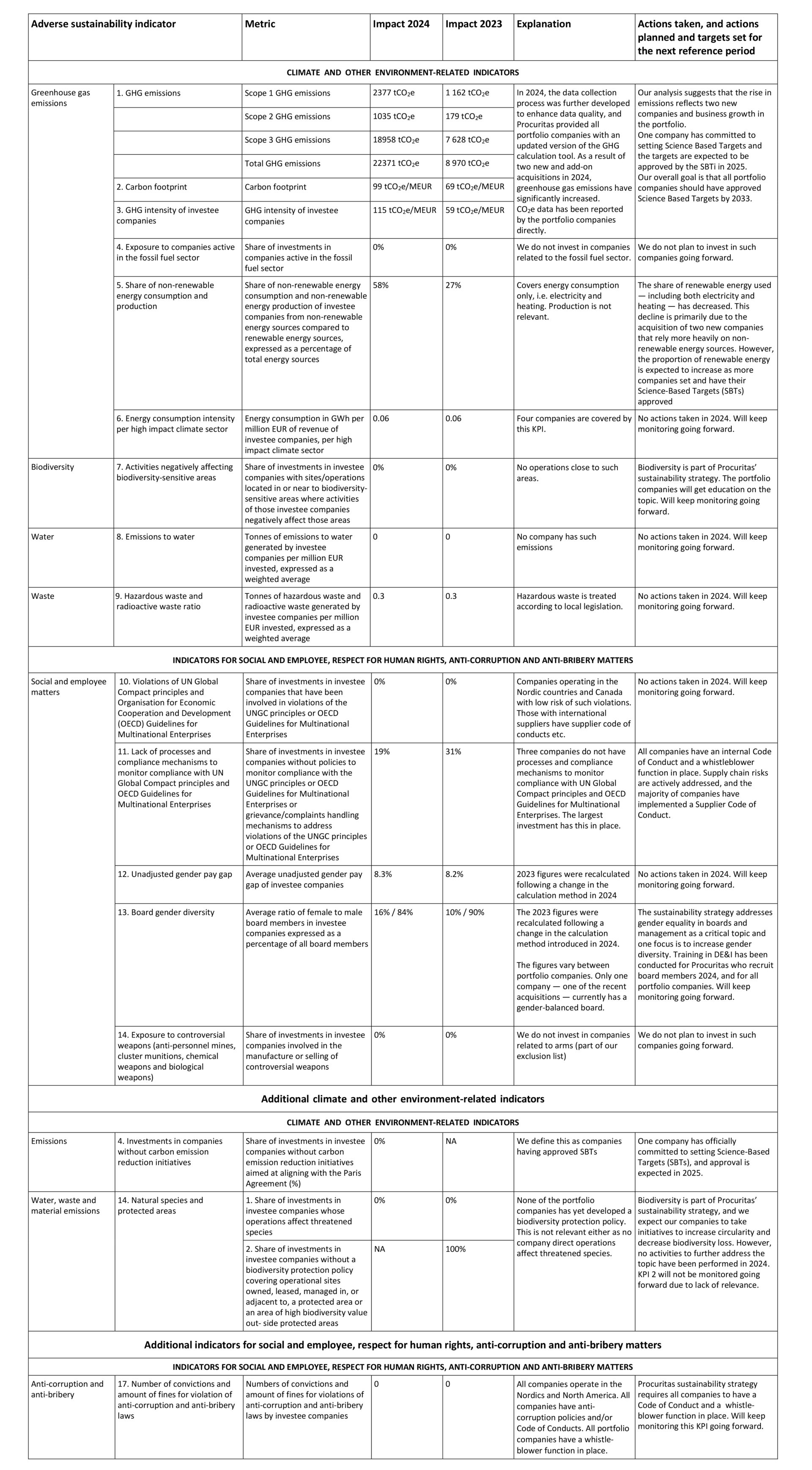

Overall, there have been some slightly negative changes in social and employee-related indicators, as well as a significant increase in greenhouse gas emissions and carbon intensity from 2023 to 2024.

Description of the principal adverse impacts on sustainability factors

Procuritas reports on the 14 mandatory Principal Adverse Impact indicators. For 2024, we have made one change to the selection of additional environmental indicators. We have removed the biodiversity indicator related to the share of investments in companies without a biodiversity protection policy for sites near protected or high-value nature areas, as our portfolio companies do not have direct impact on threatened species or biodiversity. Instead, we have added the indicator ‘investments in companies without carbon emission reduction initiatives’, which is more relevant to our portfolio and aligns with our commitment to the Science Based Targets initiative.

In the social category, we continue to monitor the indicator covering convictions and fines for violations of anti-corruption and anti-bribery laws. In addition to the Principal Adverse Impact indicators defined by the SFDR, Procuritas also monitors, among other KPIs, portfolio companies’ eNPS scores, the share of female CEOs, the share of women in top management, the share of female employees in the total workforce, and the share of companies with a Code of Conduct and a whistleblower function. Anti-corruption, diversity, equity and inclusion, and employee satisfaction are key focus areas in Procuritas’ sustainability strategy.

Description of policies to identify and prioritise adverse sustainability impacts

Procuritas has an overall Responsible Investment and Stewardship policy outlining the company’s approach to sustainability throughout the whole investment process, i.e. describing how sustainability is incorporated into the investment appraisal, due diligence and decision-making processes. The policy also outlines what industries that Procuritas will not invest in. The first version of the policy was approved by the board in September 2016 and a revised version was approved in May 2021. In addition, Procuritas has developed a Sustainability risk policy describing how sustainability risks in particular are integrated into the investment process, and how monitoring and reporting of risks are conducted. The risk policy was approved by the board in February 2022. The board is responsible for the implementation of the policies within organisational strategies and procedures.

The processes and methods described in the Responsible Investment and Stewardship and the Sustainability risk policy help Procuritas to identify the relevant principal adverse sustainability impacts for each investment in addition to identifying how sustainability risks may impact the financial returns of a product. They also enable each investment team to, throughout the lifecycle of a product’s investment, identify and manage the impact of any principal adverse impacts, or their risk of occurring, and take suitable mitigating action. Sustainability risks and principal adverse sustainability impacts are screened, monitored and measured in a manner suitable to each Procuritas product. Procuritas will never invest in companies related to arms, gambling, the sex industry or producing or wholesaling of alcohol, tobacco or drugs.

Procuritas gathers, monitors and aggregates data on the principal adverse impact indicators, both the 14 mandatory and the three being voluntary, from its Portfolio companies once a year through a digital data collection platform. Procuritas aim at selecting additional indicators based on the probability of occurrence and severity of adverse impacts (including their potentially irremediable character). Selection and assessment of relevant indicators were based on internal discussions, however a thorough analysis using data has not been conducted. The additional indicators for climate and other environment-related topics addresses carbon emission reduction initiatives and natural species and protected areas. The additional indicator for social and employee, respect for human rights, anti-corruption, and anti-bribery matters, addresses the number of convictions and number of fines for violations of anti-corruption and anti-bribery laws. IN 2024 we have removed the biodiversity indicator related to the share of investments in companies without a biodiversity protection policy for sites near protected or high-value nature areas, as our portfolio companies do not have direct impact on threatened species or biodiversity. Instead, we have added the indicator ‘investments in companies without carbon emission reduction initiatives’, which is more relevant to our portfolio and aligns with our commitment to the Science Based Targets initiative

In addition to the principal adverse impact indicators defined by the SFDR, Procuritas also monitors portfolio companies’ eNPS scores, the share of female CEOs, the share of women in top management, the share of female employees in the total workforce, and the share of companies with a Code of Conduct and a whistleblower function. Anti-corruption, diversity, equity and inclusion, and employee satisfaction are key focus areas in Procuritas’ sustainability strategy.

All the principal adverse impact data has been gathered directly from the portfolio companies. In 2024, Procuritas provided all portfolio companies with a revised GHG calculation tool.

Engagement policies

Procuritas’ Responsible Investment and Stewardship policy outlines the company’s approach to sustainability throughout the whole investment process, including ways to engage with its investee companies to make sure they have access to the resources, connections, and knowledge to address their principal adverse impacts.

For each investment, there is always a thorough assessment of principal adverse impacts conducted. Aspects covering climate change, circular economy, biodiversity, anti-corruption, anti-discrimination, diversity and inclusion, health and safety among other topics are assessed. Each investment is unique hence the relevant aspects will vary from company to company. Procuritas wants its companies to develop an awareness of their most material sustainability risks and impacts and that they develop goals and methods to address those material impacts. Topics identified during the pre-investment phase are integrated into the value creation plan of the company. Procuritas’ provides its companies with tools both to assess material sustainability aspects and to set goals to address these topics. Procuritas also provides sustainability advisory and support to its portfolio companies through its head of ESG and other ESG experts in its network whenever necessary. If a company fails to reduce its principal adverse impacts year after year this will be followed up and addressed by the portfolio company board.

References to international standards

Procuritas is currently a signatory of the United Nations Principles for Responsible Investment (UNPRI). The Responsible Investment and Stewardship policy, including the investment process, has been developed in accordance with the UNPRI principles. Each year Procuritas submit information and data to the UNPRI which assesses Procuritas’ adherence to the principles. The assessment made during the due diligence process is comprehensive and covers a broad range of sustainability topics. Procuritas has ensured that all mandatory principal adverse sustainability impact indicators and the three additional ones (please see section ‘Description of policies…’, above) are incorporated into the due diligence process. In addition, additional indicators might be added on a case-by-case basis whenever considered material. Data is collected directly from the company being subject to the sustainability due diligence.

Procuritas’ Science Based Targets (SBT), developed in accordance with the SBTi financial sector standard, were approved in 2024. Our overall portfolio coverage target is for 100% of our portfolio, by invested capital, to have approved SBTs by 2033 and 50% by 2028. To date, Procuritas gathers, monitors, and reports on climate-related adverse impact indicators, disclosing this information as part of the company’s sustainability report. While a forward-looking climate scenario has not been utilised, climate change mitigation and adaptation remain focus areas assessed during sustainability due diligence conducted by external experts.

Historical comparison

There have been some slightly negative changes in social and employee-related indicators, as well as a significant increase in greenhouse gas emissions and carbon intensity from 2023 to 2024.

Greenhouse Gas Emissions, Carbon Footprint and GHG Intensity: Across all scopes, there has been an increase in emissions from 2023 to 2024 and the increase in scope 2 and 3 has been signifiant. For example, total GHG emissions rose from 8 970 tCO2e in 2023 to 21 455 tCO2e in 2024. The carbon footprint and GHG intensity of investee companies have also increased from 2023 to 2024. There are two main reasons for these changes:

1) In 2024, we acquired two new companies, which are now included in the emissions reporting. One of them has the highest scope 2 and 3 emissions among the companies in fund 7. We also increased our investment in two of the existing portfolio companies.

2) The quality of data has improved, and the calculations now cover more categories of scope 3 emissions than in 2023.

Exposure to Fossil Fuel Sector and Non-renewable Energy: While exposure to companies in the fossil fuel sector remains unchanged at 0%, the share of non-renewable energy consumption and production has increased significantly from 27% in 2023 to 58% in 2024. This could be a result of more accurate data than the year before, but it also indicates that our companies are more dependent on non-renewable energy sources, which is not a positive trend.

Biodiversity, Water, and Waste: There are no activities negatively affecting biodiversity-sensitive areas or emissions to water reported in either 2023 or 2024. The low hazardous and radioactive waste ratio of 0.3 t/MEUR in 2023 remained the same in 2024. Hence, there have been no significant changes in these areas over the two years.

Social and Employee Matters: There is one major improvement related to the social and employee-related indicators from 2023 to 2024: the lack of processes and compliance mechanisms to monitor compliance with UN Global Compact principles and OECD Guidelines for Multinational Enterprises has decreased from 30.8% to 19.2%. However, there have been setbacks in some indicators. The unadjusted gender pay gap has slightly increased from 2% to 8.3%, and there is a deterioration in board gender diversity. Diversity, equity, and inclusion are some of our focus areas; hence, this remains an area of concern.

Read our Sustainable Finance Disclosure Regulation (SFDR) related information here:

Website Disclosure – complete in English

Procuritas – SFDR Disclosures – Principal Adverse Impacts

Principal Adverse Impacts – Summary in Swedish

Procuritas – SFDR Disclosures – Remuneration Policy

Procuritas – SFDR Disclosures – Sustainability Risks